Save on import duties with the right proof of origin

With the right papers, you will avoid unnecessary costs

Clarity on origin

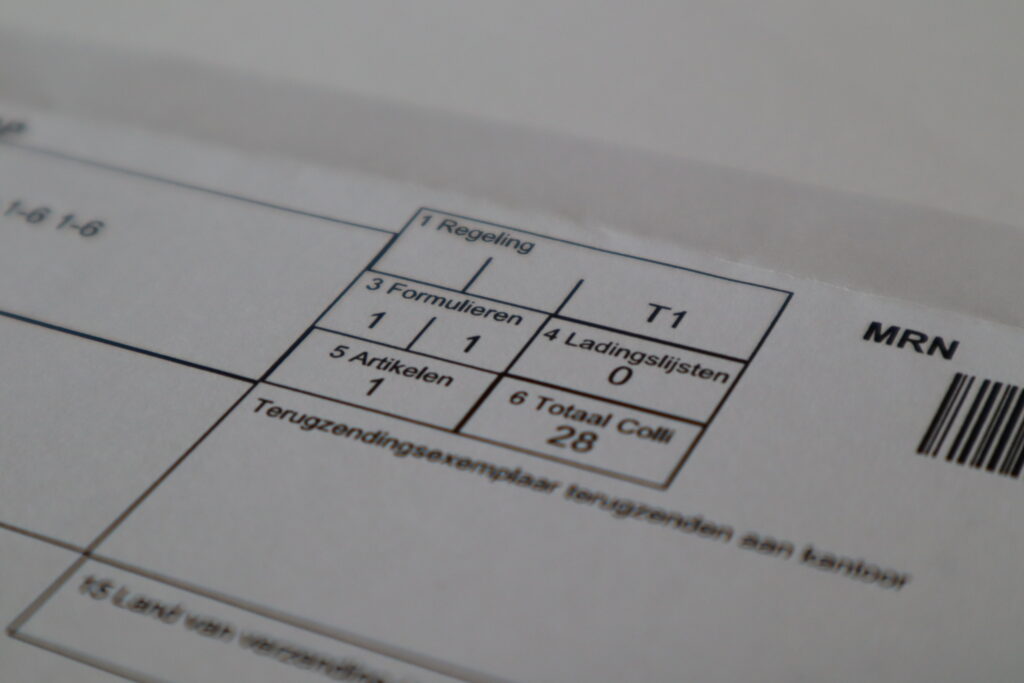

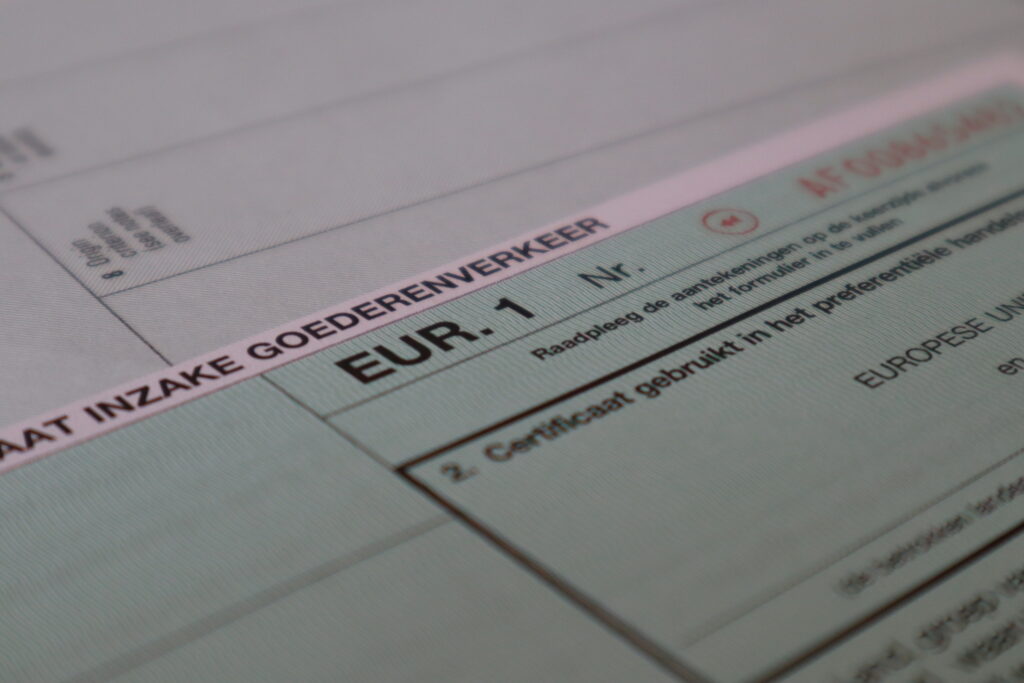

Under the trade treaty between Switzerland and the EU, import duties are waived or reduced when the goods you are exporting originate from one of the treaty countries. Depending on the value of your goods, this can save you a lot of money. With a document of origin, EUR1 certificate, or approved exporter status, you or your customer will be able to take advantage of this provision from the trade treaty.

For goods worth up to €6,000

While a declaration of origin is not compulsory when exporting goods, having an invoice with a declaration of origin on it can save you or your customer a lot of money. When you can show a declaration of origin on the invoice, the import duties will be waived or reduced significantly for goods with an invoice value of up to €6,000. The invoice with declaration of origin, complete with name and original signature, must then be given to the carrier.

Sample decleration of originFor goods worth over €6,000

If your shipment’s value exceeds six thousand euros, a declaration of origin will not do. You will then need a EUR1 certificate to enjoy the same benefits. We can apply for a EUR1 certificate for you with the Chamber of Commerce. To do so, we will need proof of origin of the goods you intend to export. The Chamber of Commerce can tell you what kind of proof of origin they accept.

Contact them

Convenience for frequent exporters

Do you export to Switzerland on a fairly regular basis? Apply for an approved exporter permit from Dutch Customs. This permit will replace the aforementioned certificates and allow you to use only copies of all the paperwork. Seeing as the application process for this permit will take at least six weeks, make sure you put in your application in good time.

Apply for permit